Are all-in-one ETFs a good investing strategy?

THE STACK #39Exchange-traded funds (ETFs) have become increasingly popular among investors due to their low fees, diversification, and ease of use. However, choosing the right one can be overwhelming with so many ETFs available. That's where all-in-one ETFs come in.

All-in-one ETFs allow you to build a diversified investment portfolio that fits your risk tolerance using just one ETF.

All-in-one ETFs are used to build a one-fund ETF portfolio, and they have become a favourite of many new investors who want to simplify their investments.

THE STACK

What are All-in-One ETFs?

All-in-one ETFs are investment funds that provide a diversified portfolio of stocks and bonds in a single fund. These ETFs are designed to be a one-stop-shop for investors who want a balanced portfolio without having to choose individual stocks or bonds.

Examples of all-in-one ETFs

1. Asset allocation ETFs: Asset allocation ETFs are designed to have a mix of equity (stocks) and fixed-income (bonds) based on different risk profiles.

Examples of asset allocation ETFs are:

Conservative Risk - VCIP, XINC

Moderately Conservative Risk - VCNS, XCNS, ZCON, FCNS

Moderate / Balanced Risk - VBAL, XBAL, ZBAL, FBAL

Moderately Aggressive Risk - VGRO, XGRO, ZGRO, FGRO

Aggressive Risk - VEQT, XEQT, ZEQT, FEQT

2. Target Date Funds: Target date funds are investment funds designed based on your expected retirement date. The name of the fund always ends with the retirement date it was created for.

Target date funds start out more aggressively with higher-risk investments, and as you approach your retirement date, they gradually shift towards more conservative investments with lower risk.

When choosing a target date fund, it's important to choose one that ends with a year closest to when you plan to retire. For example, if you plan to retire in 2057, choose a target date fund that ends in 2055. This will ensure that your investments align with your retirement goals and that you are not taking on unnecessary risk.

Benefits of All-in-One ETFs

1. Diversification: All-in-one ETFs provide broad exposure to various asset classes, including stocks and bonds. This diversification helps to reduce the risk of losses in any one asset class.

2. Low Fees: As with all ETFs, all-in-one ETFs have low fees compared to mutual funds. You can also save on management fees from robo-advisors or financial advisors since most of them follow a similar strategy as all-in-one ETFs.

3. Convenience: All-in-one ETFs provide a simple and convenient way to invest in a diversified portfolio. Investors can purchase a single ETF instead of selecting multiple stocks and bonds. It is great for new investors who want to simplify their investing strategy.

4. Ease of Use: All-in-one ETFs are easy to use and can be purchased through any brokerage account. Investors don't need to be experts in investing to get started.

5. Asset Allocation: Determining the right asset mix is one of the most challenging steps for new investors. All-in-one ETFs remove the guesswork from asset allocation, as the right mix of stocks and bonds is already pre-selected for you. All you need to know is your risk tolerance, and you choose an all-in-one ETF that fits your risk tolerance.

6. Automatic rebalancing: With all-in-one ETFs, you do not have to worry about rebalancing your portfolio every time it shifts from your target asset allocation. All-in-one ETFs are designed to automatically rebalance to meet their original goal or risk tolerance.

Cons of All-in-One ETFs

1. Limited Control: All-in-one ETFs are designed to be hands-off investments. Investors don't control which stocks or bonds are included in the fund or their allocated percentages. This means that if you want to adjust to a higher-risk fund or change your investment strategy, you will need to sell all your investments.

For instance, if you started with a balanced risk tolerance and purchased VBAL, but your confidence has grown over the years, and you're now ready to switch to an aggressive portfolio, you will have to sell your VBAL and lose your position in the market.

2. Lower returns: All-in-one ETFs are well diversified, with some containing thousands of stocks and bonds. While this is great for reducing your risk, it also means that it lowers your returns.

One Fund vs Four Fund Portfolio

In my previous newsletter, I explained how to build a four-fund portfolio. Some of you have asked why not just buy a one-fund ETF instead since the four-fund portfolio already contains the same ETFs.

With four-fund ETFs, you have better control of your asset allocation which means you can tweak your asset allocation to optimize your returns.

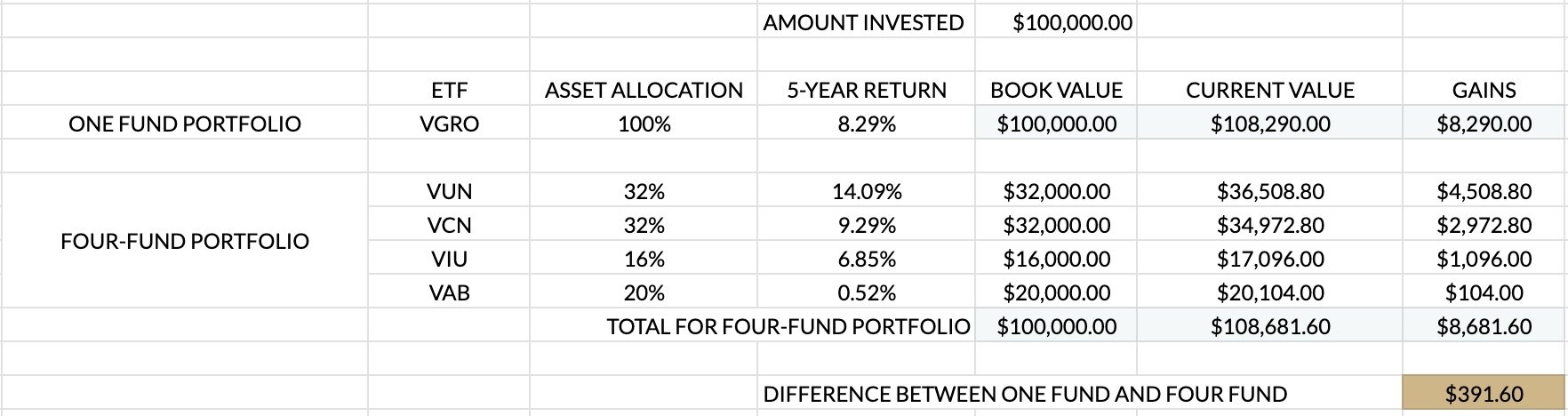

Let’s compare $100,000 invested for five years in a one-fund portfolio to a four-fund portfolio using a moderately aggressive risk tolerance of 80% stocks and 20% bonds.

The difference in gains between the one-fund portfolio and the four-fund portfolio is only $391.60.

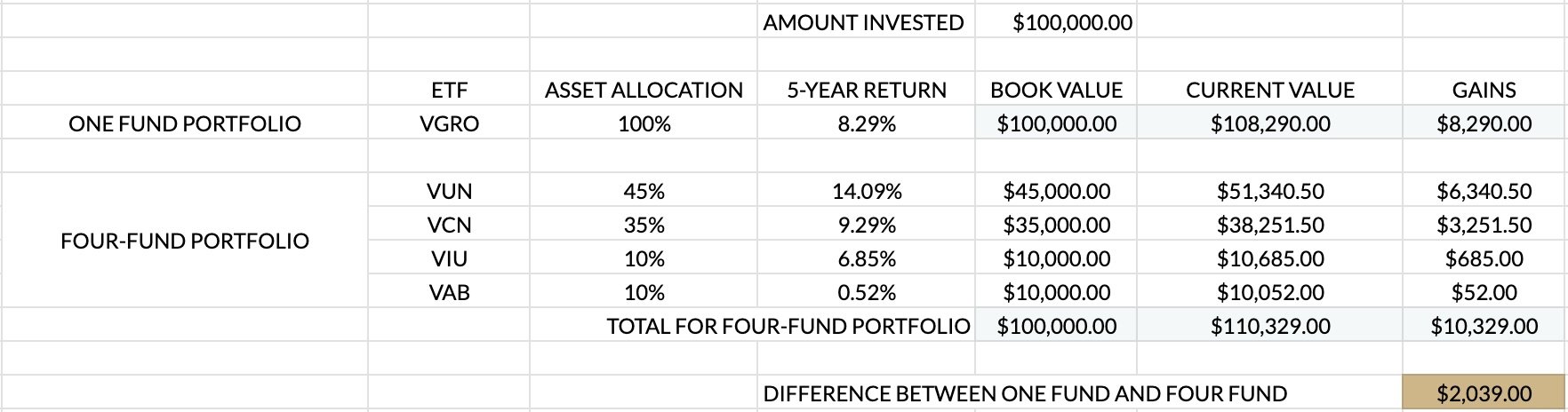

If an investor looked at the market history and decided that they wanted to reduce their bond allocation by 10% because bonds haven’t been performing well, this would boost their gains by $1,748.60.

If they observed that the international market hadn’t been performing well and decided to decrease their international position and boost their US and Canada allocation, this would further boost their gains by $2,039.

We can see from these examples that using a four-fund portfolio gives you more control to optimize your investment portfolio to maximize your gains.

What goals can I use a one-fund ETF portfolio for?

All-in-one ETFs or a one-fund portfolio are best for short- to mid-term goals because they are easier to manage and have lower risk in the short term.

Examples of some goals you can use an all-in-one ETF include:

Down payment

Tuition

Wedding

Vacation

What goals can I use a four-fund ETF portfolio for?

A portfolio consisting of four different funds is a more suitable option for long-term financial goals, such as retirement or investing for your children.

This type of portfolio gives you the flexibility to make necessary adjustments based on current stock market events, which will ultimately help you maximize your long-term gains.

THE TOOL

The Risk Score Matrix

The Risk Score Matrix helps you determine your risk tolerance using a scoring model based on Age, Investment horizon, Goal Urgency, Portfolio Size and Risk Comfort.

It is a proprietary tool I created that has helped 100s of people determine their asset allocation down to the exact percentage of the equity and fixed income for each country allocation.

It is currently only available inside the Stack My Dime Blueprint because the course teaches you how to use the tool correctly.

THE ACCOUNTABILITY

Calculate your risk tolerance and asset allocation. Then, determine if a one-fund or fund-fund portfolio is right for you based on your goals.

THE COURAGE

THE KNOWLEDGE

Diversification

Diversification is a risk management strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce the overall risk of a portfolio.

It is based on the principle that not all investments will perform the same way at the same time, so by diversifying, investors can potentially reduce their exposure to any one particular investment or sector.

Asset Allocation

Asset allocation is the process of dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash, based on an investor's goals, risk tolerance, and investment time horizon.

The goal of asset allocation is to create a diversified portfolio that can provide the potential for long-term growth while minimizing risk. By diversifying across asset classes, investors can potentially benefit from the performance of different types of investments and reduce the overall risk of their portfolio

Keep Stacking!

about the newsletterEvery Saturday, subscribers will receive one money tip, one tool, one actionable step, one word of courage and learn a new finance term to help you gain control of your finances in less than five minutes.

Free resourcesKeep reading the latest NEWSLETTERS

How to cycle sync your finances