Everything you should know about the First Home Savings Account (FHSA)

THE STACK #32The First Home Savings Account (FHSA) was launched in April 2023, and many Canadians are still getting used to all the rules surrounding the FHSA.

Today’s Stack will dive into everything you should know about the FHSA.

THE STACK

What is an FHSA?

The First Home Savings Account (FHSA) is a registered account designed to help Canadians save towards the purchase or build of their qualifying first home tax-free.

How does the FHSA help me save on taxes?

Your FHSA contributions and withdrawals are tax-free. This means you get a tax deduction on any contributions to your FHSA.

Any capital gains and dividends earned inside your FHSA will not be taxed. You will also not be taxed on any withdrawals made from your FHSA.

Example:

You earned $88,000 in 2023 and contributed $8,000 to your FHSA the same year.

When filing your tax return, you can claim the $8,000, bringing your taxable income down to $80,000 and helping you save on taxes.

If you invest the $8,000 and it grows to $10,000 in 5 years, you will not be taxed when you withdraw the $10,000.

What is my contribution limit for FHSA?

Your participation room is the maximum amount you can contribute to your FHSA without generating an excess.

The FHSA participation room is $8,000 annually and has a lifetime limit of $40,000.

Who is eligible for an FHSA?

To open an FHSA account, you must be:

18 years or older (or the legal age of your province).

71 years or younger as of December 31st of the year you open your FHSA.

A resident of Canada.

A first-time home buyer for the purpose of opening an FHSA.

Who is considered a first-time home buyer to qualify for an FHSA?

To qualify as a first-time home buyer for the purposes of opening an FHSA, you need to meet either of these criteria:

You haven’t lived in a qualifying home as your primary residence this calendar year or in the last four calendar years. This includes a home that:

You own solely or jointly

Your spouse owns solely or jointly

You do not have a spouse or common-law partner when you open an FHSA

What is a qualifying home?

A qualifying home is a housing unit located within Canada. The home could be pre-existing or under construction.

Examples of homes that qualify:

Single-family homes

Semi-detached homes

Townhouses

Mobile homes

Condominium units

Apartments in duplexes, triplexes, fourplexes, or apartment buildings

A share in a co-operative housing corporation that entitles you to own and gives you an equity interest in a housing unit

Who is considered a resident of Canada?

A resident of Canada is someone who has an income tax obligation to Canada.

Where can I open a FHSA?

You can open a new FHSA at any FHSA issuer; this includes investment brokerages, banks, credit unions, trust or insurance companies.

What documents will I need to open an FHSA?

To open an FHSA with an FHSA issuer, you will need to provide the following:

Social Insurance Number (SIN)

Date of birth

Valid Identification

Can I have more than one FHSA account?

You can open multiple FHSA accounts at multiple financial institutions as long as all your FHSA contributions combined do not exceed your maximum participation room for the year.

Can I transfer money from my RRSP to my FHSA?

You can transfer cash or investments from your Registered Retirement Savings Plan (RRSP) to your FHSA.

The transfers from your RRSP to your FHSA will count towards your maximum participation room.

You must request a direct transfer from your financial institution to avoid a taxable withdrawal from your RRSP.

The transfers from your RRSP to your FHSA are not tax-deductible.

What happens to my unused FHSA contribution room?

You can carry over any unused participation room from the previous year up to a maximum of $8,000.

Your unused FHSA participation room is calculated as follows:

Your FHSA participation room for last year

minus

All new contributions to your FHSA and transfers from your RRSP

Your FHSA participation room for this year is calculated as follows:

Your participation room for this year ($8,000)

plus

Your unused participation room from last year (up to a maximum of $8,000), subject to the lifetime FHSA limit.

Can I contribute $40,000 to my FHSA this year?

Even though you have a lifetime limit of $40,000 for your FHSA, you cannot contribute a lump sum of $40,000 in one year.

Because you can only carry over a maximum of $8,000 from the previous year, the maximum you can contribute in any given year will be $16,000.

What happens if I over-contribute to my FHSA?

If the amount you contribute to your FHSA and the transfers from your RRSP to your FHSA exceeds your maximum participation room for the year, you will have an excess amount.

You will be taxed 1% per month on the highest FHSA amount for that month. You will continue to be taxed 1% monthly until the excess amount is removed.

How do I remove the excess amount I contribute to my FHSA?

The excess amount contributed is called the designated amount.

You can remove or reduce the excess amount through one of the following methods:

Withdraw the designated amount from your FHSA.

Directly transfer the designated amount from your FHSA to your RRSP. A designated transfer will not affect your unused RRSP contribution room.

Make a taxable withdrawal from your FHSA.

You must make a designated transfer or withdrawal using the form RC727, Designate an Excess FHSA Amount as a Withdrawal from your FHSA or as a Transfer to your RRSP or RRIF and submit it to your issuer.

You can only make a designated withdrawal if your contribution to your FHSA results in an excess FHSA contribution. You cannot make a designated transfer from your contributions to your FHSA.

You can only make a designated transfer if you made a transfer from your RRSP to your FHSA that resulted in an excess FHSA contribution. You cannot make a designated withdrawal from a transfer.

Does the income I earn from my investments affect my FHSA participation room?

No, the income earned through capital gains, dividends, distributions, or interest does not affect your participation room.

Should I open an FHSA if I am not ready to buy a home yet?

To inform the CRA that you have an FHSA, you need to open your account and file your tax return. The year you open your FHSA and file your tax return will be considered as the starting point for counting your FHSA participation room.

It's important to note that you can only keep your FHSA open for a maximum of 15 years. If you're planning to purchase your first qualifying home within the next 15 years, it's advisable to open an FHSA and start saving towards this goal.

Can I open an FHSA if my spouse already owns a house?

If your spouse owned or co-owned a primary residence within the last four years, you do not qualify for an FHSA.

If I owned a property when I was single years ago, can my spouse open an FHSA?

If you lived in the property as your primary residence in the last four years, your spouse cannot qualify for an FHSA.

Do I lose my FHSA contribution room if I don’t contribute the maximum?

You can carry forward any unused contribution room up to a maximum of $8,000 in a given year. Any excess contribution room will be forfeited for the next year if you exceed this amount. However, the forfeited amount will not affect your lifetime limit of $40,000.

For example:

You opened an FHSA in 2023 but did not use your $8,000 contribution room.

In 2024, your total contribution room will be $16,000 ($8,000 from the previous year plus another $8,000 for the current year).

If you contribute $3,000 in 2024, your remaining contribution room for the year will be $13,000.

In 2025, you can only carry forward a maximum of $8,000.

This means that you will "lose" $5,000 in contribution room, but in reality, you have not lost it. The $5,000 you forfeited will not affect your lifetime limit of $40,000. You can continue contributing up to your maximum participation room each year until you reach your lifetime limit.

Can I transfer from my FHSA to my RRSP?

You can transfer cash or investments from your FHSA to your RRSP directly.

Can I transfer from my FHSA to my RRSP even if I no longer have RRSP room?

The amount transferred directly from your FHSA to your RRSP will not affect your unused RRSP contribution room as long as it is a direct transfer from your financial institution.

How long can I hold an FHSA for?

You can hold your FHSA from the year you first opened it until December 31st of the year in which the earliest of any of the following occurs:

The 15th anniversary of opening an FHSA

You turn 71 years

The year after you make your first qualifying withdrawal

What happens to my FHSA if I don’t use it after 15 years?

If you have any assets in your FHSA by the end of your participation period, you can transfer them directly to your RRSP.

However, if the assets remain in your FHSA by the end of the 15-year period, it will no longer be considered an FHSA and will be deregistered. In such a case, you must include the fair market value of the assets in your FHSA as of December 31st of that year in your income.

How can I withdraw from my FHSA?

Withdrawals from your FHSA for the purpose of acquiring your qualifying first home are known as qualifying withdrawals.

To make a qualifying withdrawal from your FHSA, you need to meet all these terms:

You haven’t lived in a qualifying home in the calendar year that you purchased the home or the previous four calendar years. This includes a home owned or co-owned by you or your spouse.

You must have a written agreement to build or buy your qualifying home with an acquisition or construction date before October 1 of the year following the year of withdrawal.

You must not have acquired the home more than 30 days before your withdrawal.

You must be a Canadian resident from the time you make your first withdrawal until the date you acquire your home.

You must occupy your home as your primary residence within one year of buying or building it.

You must fill out Form RC725 Request to Make a Qualifying Withdrawal from your FHSA and give it to your FHSA issuer.

Can I still contribute to my FHSA if I bought a home this year?

You can claim your FHSA contributions up to 30 days after you have purchased a qualifying home as long as you meet all the requirements to make a qualifying withdrawal.

What happens to my FHSA after I make a withdrawal?

You should close all your FHSAs by December 31 of the following year after you make a qualifying withdrawal.

How long do I have to hold my contributions in my FHSA before I can claim a tax deduction?

You can receive a tax deduction for any contributions you make to your FHSA between January 1st and December 31st of any given year.

There is no minimum time limit for how long your contributions need to stay in your FHSA before you can deduct them on your income tax and benefit return.

What types of investments can I hold in my FHSA?

The types of investments you can hold in your FHSA include the following:

Most securities listed on a major stock exchange

Mutual funds

Bonds

Guaranteed Investment Certificates (GICs)

Cash

How is the FHSA different from the TFSA?

Unlike the Tax-Free Savings Account (TFSA), where you contribute your post-tax income, in your FHSA, you contribute your pre-tax income.

You can claim your FHSA contributions as a tax deduction, whereas in your TFSA, you cannot claim your contributions as a tax deduction.

In your TFSA, you can carry over any unused contribution room up to your maximum lifetime limit. In your FHSA, you can only carry over unused contributions up to a maximum of $8,000.

How is the FHSA different from the RRSP?

Withdrawals from your RRSP are always taxed, while your qualifying withdrawals from your FHSA are tax-free.

You can carry over any unused contribution room up to your maximum lifetime limit in your RRSP. In your FHSA, you can only carry over unused contributions up to a maximum of $8,000.

What happens to my FHSA if I become a non-resident?

If you move out of Canada after opening your FHSA, you can continue to contribute, but cannot make qualifying withdrawals for home purchase or construction while a non-resident.

Can I use my FHSA to buy a rental property?

You need to live in the property as your primary residence within one year of buying it.

THE TOOL

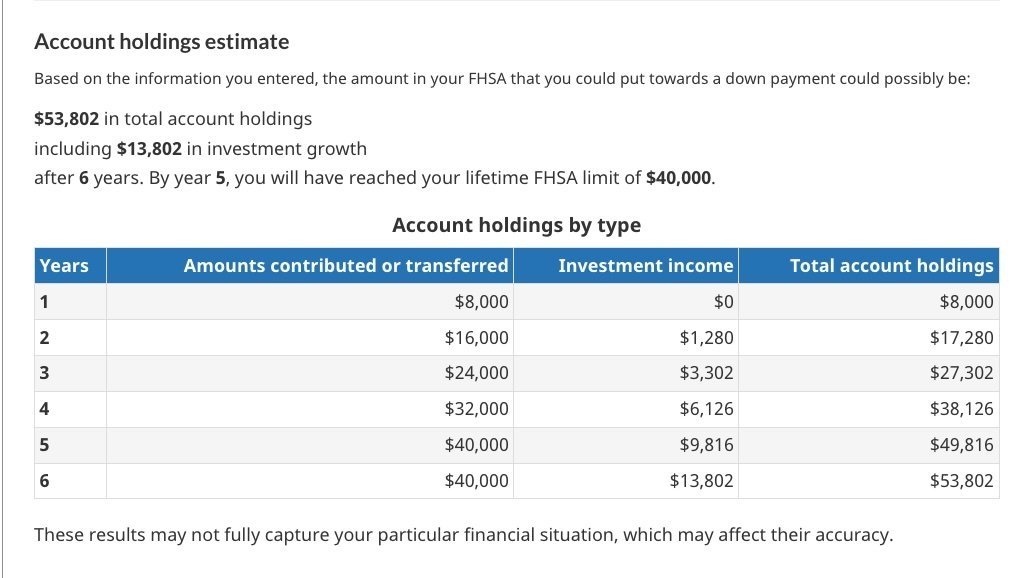

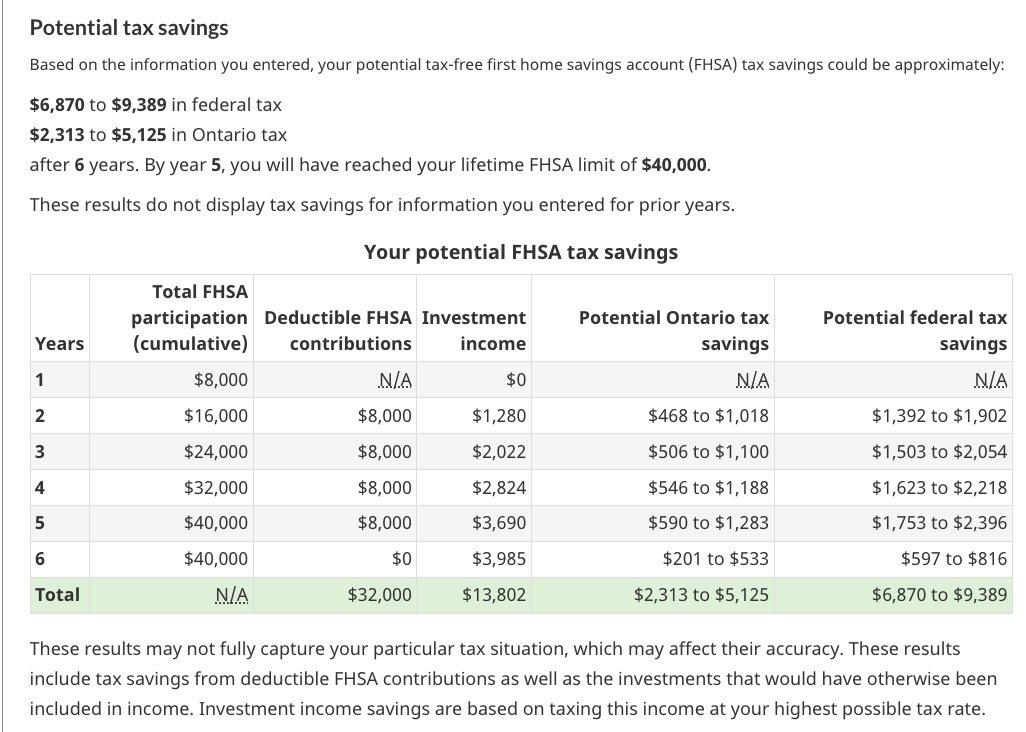

Tax-Free First Home Savings Account Estimators

This free estimator helps you understand how your FHSA can help you save for your next home and see your potential tax savings.

THE ACCOUNTABILITY

Do you have plans to buy a home in the next 15 years and qualify for the FHSA? Open an account and start saving or investing towards the purchase of your home.

Did you open an FHSA account in 2023? Ensure you file your income tax return to let the CRA know you have opened a FHSA. You must do this even if you did not contribute to your FHSA in 2023.

THE COURAGE

THE KNOWLEDGE

FHSA Participation Room

Your FHSA participation room for the year is the maximum amount that you can contribute to your FHSAs or transfer from your registered retirement savings plans (RRSPs) to your FHSAs in the year without creating an excess FHSA amount.

Fair Market Value

The fair market value is the reasonable and impartial estimate of the potential price that an asset, service, or property can command in the open market, considering both the buyer's and seller's perspectives, without any undue influence or pressure.

That's it for this week's STACK!

Talk to you next week,

But until then...

Keep Stacking!

about the newsletterEvery Saturday, subscribers will receive one money tip, one tool, one actionable step, one word of courage and learn a new finance term to help you gain control of your finances in less than five minutes.

Free resourcesKeep reading the latest NEWSLETTERS

How to cycle sync your finances