Stock lending may be risky - Here’s what you need to know

THE STACK #31Wealthsimple recently introduced Stock Lending on their platform, which allows you to lend your stocks and earn interest. While this may seem like a simple way of earning passive income, it is vital to understand the potential risks before lending your stocks.

In today's Stack, I will outline the advantages and disadvantages of stock lending to help you make an informed decision.

THE STACK

How does Stock Lending work?

Stock lending is when an investor borrows your stocks, and in return, you earn interest.

The interest earned is usually split between you and the brokerage you trade with.

You still retain ownership of the stocks while they are loaned out and make money when the stock increases in value.

If you no longer want to lend your stocks, you can recall them from the borrower or sell them while they are loaned out.

Why would someone want to borrow my stocks?

Short-selling

Stock lending has been around for a long time. Investors typically borrow a stock when they want to short-sell it.

Short-selling a stock is when an investor places a bet that the stock price will decrease. They borrow a stock from a brokerage and immediately sell it, hoping the stock price will fall soon. Then, they buy back the stock at a lower price, return it to the brokerage and pocket the difference minus any fees and interest.

Here’s an example:

Stephanie borrows 100 shares of TSD at $20/share for $2,000.

The brokerage charges her 5% interest and $50 fees.

She immediately sold the 100 shares of TSD and has $2,000 cash.

The stock price dropped to $10/share a few days after investors shorted TSD stocks.

Stephanie then bought back 100 shares of TSD stocks at $10/share for $1,000.

Stephanie returned the 100 shares of TSD she borrowed.

After she pays the 5% interest and fees of $100, she gets to keep the remaining $900 as profit.

Collateral

When companies want to borrow large sums of money, they need to prove that they can pay back by showing they have enough assets to cover the loan if they default. Some companies borrow stocks to increase the value of their assets and help them qualify for the loan.

Institutional lending

Institutions can borrow stocks to meet regulatory obligations such as maintaining a particular number of securities. Some institutions also borrow stocks to increase their votes in a company and influence critical decisions.

What are the advantages of stock lending?

Earn Interest

Investors who hold a stock for the long term earn a profit when the stock price goes up and through dividends.

Another way to profit from your stocks is by lending them and earning interest.

The brokerage you hold your stock with ensures that the borrowers leave enough collateral, which helps protect you from the downside of the borrowers defaulting.

Lending your stocks is one way to earn passive income by doing nothing.

What are the risks of stock lending?

Losses from short-selling

You can lend both stocks and ETFs, but investors that borrow stocks are typically interested in stocks they can short so they can profit.

If you own a stock that investors want to short, your stock could lose value significantly. Even if you make money from interest, you will incur a more significant loss if the stock loses value.

In the example above, Let’s say the stock earned $50 in interest by lending it. Your brokerage will split the interest 50/50, so you earned $25.

If your stock price dropped from $20/share to $10, you would have lost $1,000 to earn $25. Is that risk worth it to you?

No CIPF coverage

The Canadian Investor Protection Fund (CIPF) covers your securities held in a member brokerage up to $1,000,000.

CIPF does not provide coverage to any securities you lend. The brokerage could return the collateral they collected from the borrower, which could be significantly less than the market value of your stocks if the stock price has increased since you loaned it.

You will not receive your loaned securities or collateral if the brokerage becomes insolvent or bankrupt.

Losses from market fluctuations

When you loan your stock, you maintain ownership of the stock. Your equity increases if the market price increases while your stocks are loaned out. If the market price goes down, your equity decreases. The decrease in market price will also affect the value of the collateral held because the collateral is set as a percentage of the value of the stock borrowed. If the borrower defaults, this could reduce the amount you get back from your brokerage.

Limitations to sell your stock while it is loaned out

If you recall your stock while it is loaned out, it could take up to five trading days for the transaction to clear.

If the market value of your stock drops while it is loaned and you recall or sell it, you could end up with a stock with significant losses due to the lag in transaction time.

Tax implications

If the securities you loan out pay dividends or distributions, you are entitled to receive those payments. These payments on loaned securities are called manufactured payments, and they have different tax implications that could result in a tax bill. You may not receive the foreign tax credit if you loan foreign securities.

You are entitled to retain the cash collateral held by your brokerage if the borrower defaults. Retaining the cash collateral will result in a taxable transaction. You may be required to pay taxes on the gain (the difference between the collateral and the borrowed amount). However, the allowable loss you can claim may be limited.

Waive your voting rights

When your securities are loaned out, you lose voting rights. Remember I mentioned that one of the reasons that some institutions borrow is to increase their voting rights. The institutions might vote for a decision contrary to how you may have wanted to vote, so when you loan your stocks, you’re giving up your decision-making power.

No control over which securities get loaned

When you opt to participate in stock lending, you don’t have any control over when to initiate or terminate loans of specific securities. To terminate the loan, you will have to terminate your participation in the program.

THE TOOL

Is your brokerage CIPF insured? You can verify on the CIPF website by looking at their member list to see if your brokerage is a member.

THE ACCOUNTABILITY

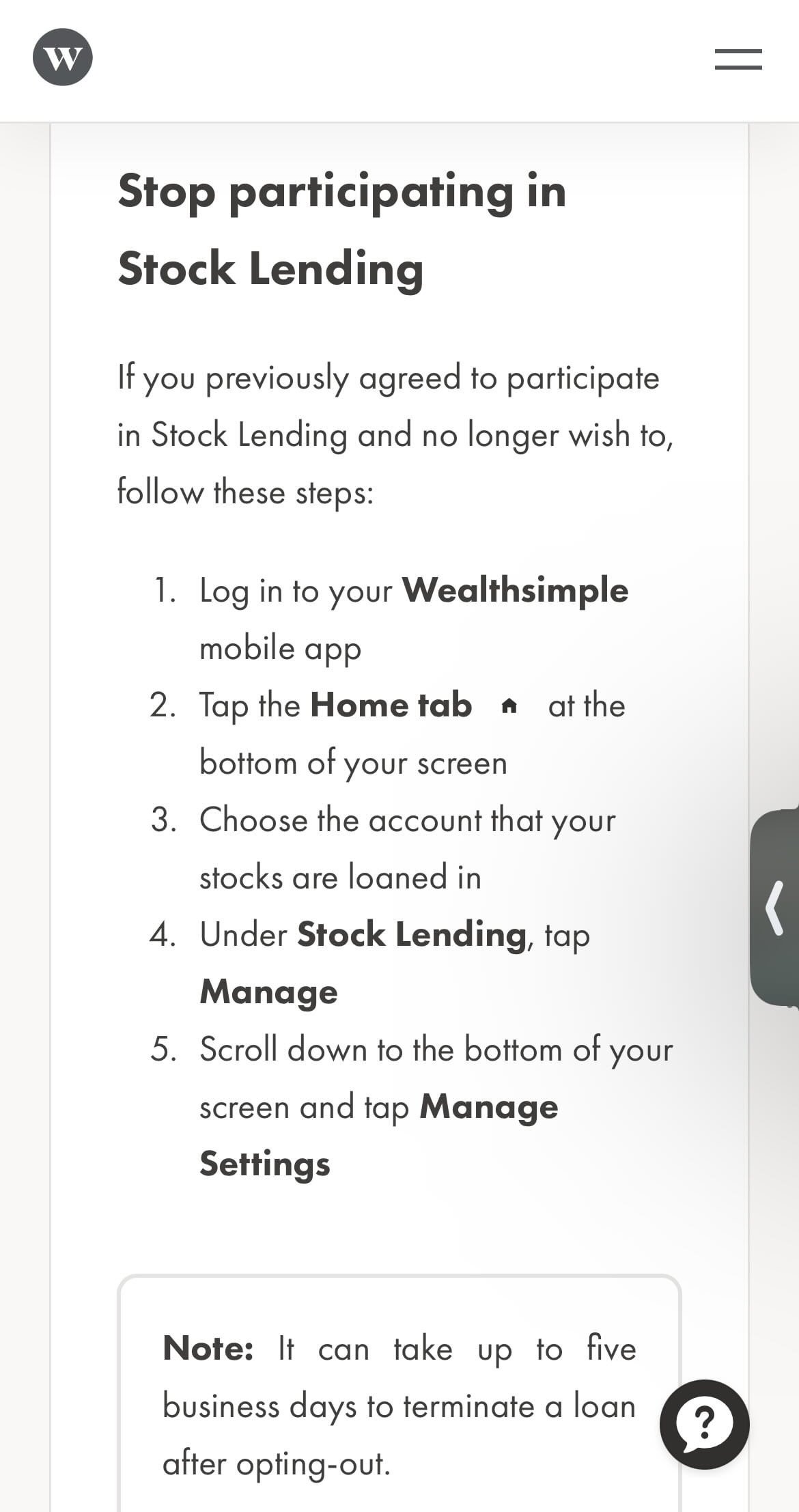

Some people have noticed that Wealthsimple automatically opted them in for Stock Lending. If you don’t want to participate in Stock Lending, ensure that this option is turned off in your Wealthsimple App.

THE COURAGE

THE KNOWLEDGE

Security

Security refers to a fungible, negotiable financial instrument that holds monetary value. It is a broad term for different types of investments, such as stocks, bonds, exchange-traded funds and options.

Long Position

A long position, often called “go long,” is when an investor buys and owns shares of stock. The investor makes money from the increase in the stock's market value.

Short Position

A short position, often called “go short,” is when an investor borrows a stock and bets on the stock decreasing in value. The investor makes money from the decline in the stock's market value.

That's it for this week's STACK! Talk to you next week but until then...

Keep Stacking!

about the newsletterEvery Saturday, subscribers will receive one money tip, one tool, one actionable step, one word of courage and learn a new finance term to help you gain control of your finances in less than five minutes.

Free resourcesKeep reading the latest NEWSLETTERS

How to cycle sync your finances