Are mutual funds bad? Read this before you sell

THE STACK #24Now and then, I get a frantic DM from a follower saying, “I have been investing in Mutual Funds for a while because I was told they were great; now everyone is saying they are bad. What should I do? help!”

Mutual Funds have been getting a bad rap over the last few years, and rightly so, but before you run off and sell your mutual funds, there are a few things to consider.

In today’s STACK, we will dive into how to gauge if your mutual fund is worth keeping.

THE STACK

So, are Mutual Funds bad?

The simple answer is NO.

Mutual Funds pool the money of several investors to generate capital to invest in various assets.

Mutual Funds (MFs) allow investors to own multiple securities of different asset classes from various industries or countries all in one fund.

MFs are a great way to diversify your investment portfolio, lower risk, and eliminate the guesswork of picking great companies.

This concept is great for any investor.

A fund manager manages mutual funds and selects the companies to buy and sell based on their performance and potential to make the fund money.

Investors pay a management fee as a reward for their hard work.

Other costs are associated with managing the fund, which all get tied into the Management Expense Ratio (MER).

The MER is a percentage of the investor’s overall portfolio.

The problem is that these fees are usually high and erode the investor’s returns over time. For this reason, many investors no longer find Mutual Funds desirable.

Should you get rid of your Mutual Funds?

First, perform a profit vs cost analysis of your Mutual Fund.

MFs have a benchmark they aim to outperform.

Look at the fund’s returns after fees.

Has your MF outperformed this benchmark consistently?

If the MF is performing well, it’s making you money.

Your main goal as an investor is to make money. So if your MF makes you money, why ruin a good thing?

Will this performance help you achieve your goals?

Before you invest, you should have a target rate of return to help you achieve your goals.

Is the fund meeting this target?

Your target should be your ultimate benchmark.

If your fund hasn’t met this target in the last five years, it never will. So it may be time to break up.

Count the cost

Calculate how much the fund will cost you over time.

Some online calculators help with this (see THE TOOL section).

If the cost is negligible, don’t sweat it.

Assess the break-up fee

Most mutual funds have a holding period. A fee will apply if you sell the fund before this period ends, usually 2% of the value.

It might be worth it to wait until this period has elapsed.

Some MFs also have a back-end load fee, a fee charged for selling the fund.

Ensure the fee won’t end up costing you more.

Timing is everything

If you’ve decided that your MF is worth holding on to, you should find the right time to sell it.

If the stock market has crashed and your fund has suffered a massive loss, selling it means you will lose money.

You don’t want to sell at a loss. This is the cardinal rule of investing.

Hold on to it until the market recovers.

In the meantime, you can take advantage of the stock market sale to invest in your favourite index fund or ETF.

THE TOOL

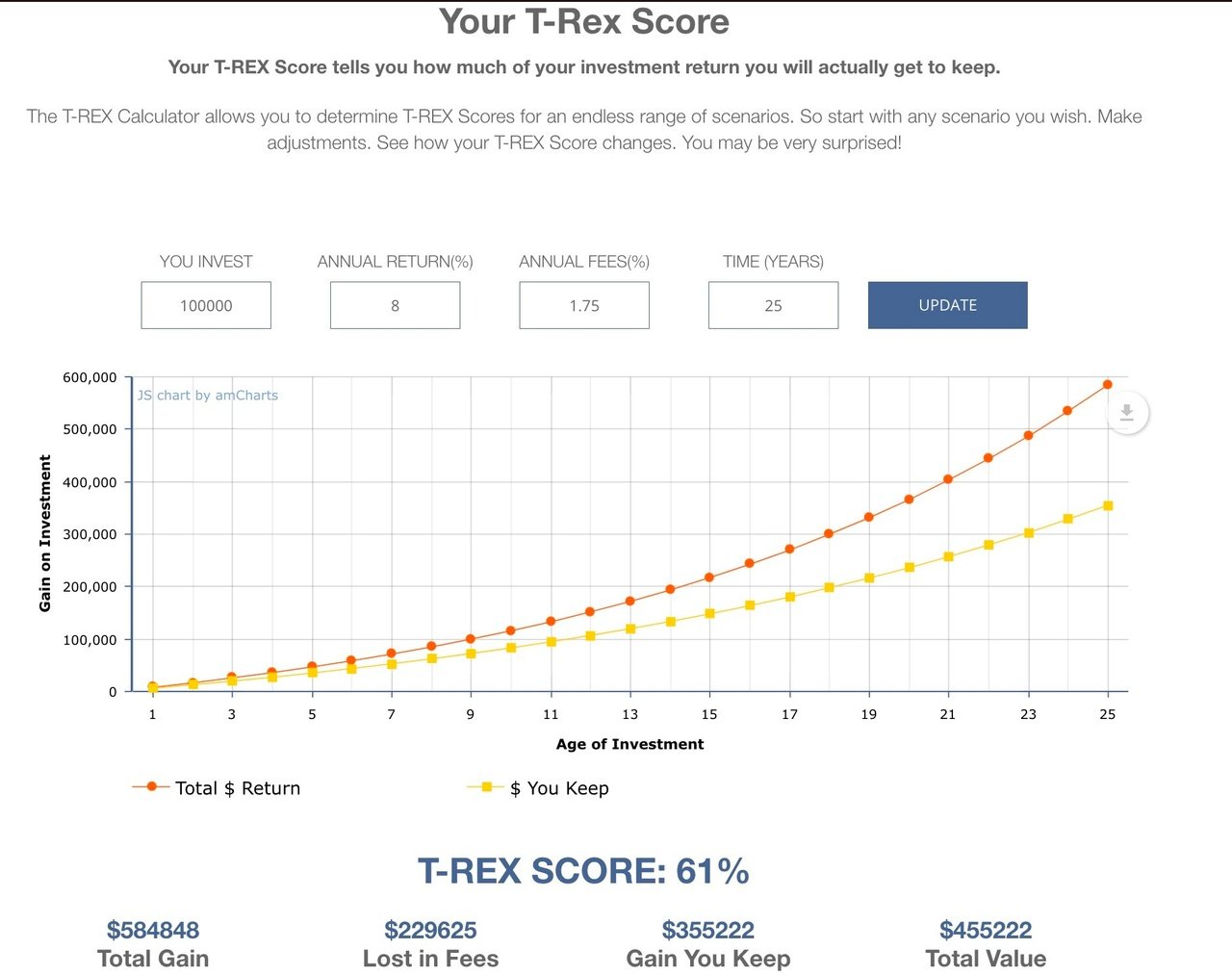

CALCULATE YOUR T-REX SCORE

I love this calculator by Larry Bates, which helps you evaluate the cost of your fund and how it affects your returns.

Use this to assess how much your fees cost.

He also wrote a book called Beat the Bank. I highly recommend you read it.

THE ACCOUNTABILITY

Calculate the T-REX score of each mutual fund you own.

Take a screenshot and tag me on Instagram!

THE COURAGE

THE KNOWLEDGE

LOAD FEES

A load is a sales charge or commission a fund manager charges an investor when buying or redeeming shares in a Mutual Fund.

TRAILING COMMISSION

A trailing commission is an ongoing charge for services or advice provided by a Mutual Fund representative such as a Mutual Fund Broker or Financial Advisor.

Trailing commissions are paid out of the fund’s management fee and could contribute to a high MER of a fund.

A high trailing commission could incentivize Mutual Fund Brokers or Financial Advisors to sell MFs with high MER to you because they will earn a commission as long as you hold on to the fund.

Luckily, Canada finally abolished this fee in June 2022. Yay, Canada! On a positive note, most MF fees will reduce, so don’t be in a hurry to sell your fund just yet.

MANAGEMENT EXPENSE RATIO

Management expense is the total cost of managing a fund. These costs include operating expenses, legal fees, interest, trading fees and the fund manager’s salary.

The management expense ratio is a percentage of the fund’s value.

If you have questions about your Mutual Funds, send me a DM on Instagram (let me know you read this newsletter so you can get a response).

That's it for this week's STACK!

Talk to you next week,

But until then...Keep Stacking!

about the newsletterEvery Saturday, subscribers will receive one money tip, one tool, one actionable step, one word of courage and learn a new finance term to help you gain control of your finances in less than five minutes.

Free resourcesKeep reading the latest NEWSLETTERS

How to cycle sync your finances