7 streams of income and how to use them

THE STACK #20Today's newsletter is special because it's our 20th issue!! 🎉🎊 #consistency

We also hit our 1,000 subscriber mark 🙌🏾

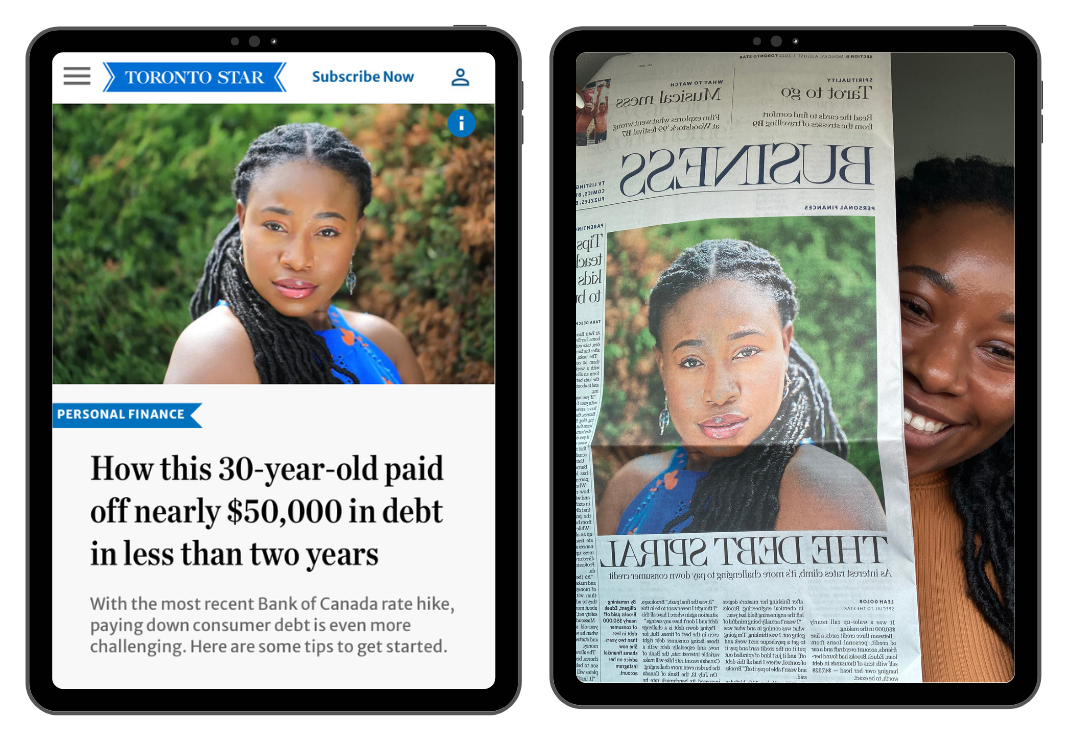

Plusssss, your girl got featured on the front page of the Toronto Star business section.🤯😱

I am still mind-blown every day as to how my journey from being in debt has brought me to a place where I'm educating and encouraging thousands of people on how to win with their money.

I couldn't have asked for a better job!

In today's STACK, we will learn how to earn from 7 streams of income.

THE STACK

Stream #1: Earned Income

This is income earned when you exchange your skills or services for compensation.

It could be income earned as an employee or from being self-employed.

This is usually the primary and most stable source of income for most people.

How to earn this:

❖Get hired as an employee.

Stream #2: Dividend Income

A dividend is a distribution of a company's profits to its shareholders.

Dividends can be paid monthly, quarterly or annually.

How to earn this:

❖Buy shares of a company or ETF that pays dividends.

Stream #3: Rental Income

This is income earned from rent paid by tenants who occupy your property.

How to earn this:

❖Rent out part of your primary residence

❖Buy a rental property

❖Participate in crowdfunding real estate

❖Buy REITs

Stream #4: Interest Income

Interest is an amount charged on a loan.

How to earn this:

❖Savings accounts

❖Bonds

❖Peer-to-peer lending

❖Guaranteed Investment Certificates (GICs)

❖Certificate of Deposits

❖Treasury Bills

❖Money Market accounts

Stream #5: Profit / Business Income

This is income earned from the sale of goods or services after expenses and taxes have been accounted for.

This stream of income offers the most variety of revenue streams.

You can have one or several.

How to earn this:

❖Start a brick-and-mortar or online business

Stream #6: Capital Gains

Capital gains are the profit earned from an investment or property sale.

How to earn this:

❖Invest in index funds, ETFs, stocks, bonds etc.

Stream #7: Royalty Income / Licencing Income

A royalty is a legally binding payment made to an individual for the ongoing use of their work, assets, franchise or intellectual property.

You earn a set percentage every time someone uses your work.

How to earn this:

❖Write music

❖Write a book

❖Write a score for a movie

❖Create a patent

Creating multiple streams of income isn't something that happens overnight.

For the first few years, you'll earn little to no income.

The key is staying consistent and reinvesting those profits until you hit your FREEDOM NUMBER.

THE TOOL

Looking to start an online business where you can sell your skills or knowledge through digital products?

Kajabi, the platform I use to power Two Sides of a Dime, has brought back one of their best deals: 3 months of the industry’s top online business platform for only one payment of $99.

That’s three months to monetize your content and turn what you know into an online course, coaching program, membership site, subscription, or podcast.

You can also build websites, create marketing campaigns, collect payments, and more. And because Kajabi is an all-in-one platform, you don’t have to worry about what to piece together next — it’s all connected.

This is my favourite part about using Kajabi, as I love having everything in one place. It's the tool I'm using to send out this newsletter!

If you've ever thought about starting an online business but aren't sure where to begin, this is an opportunity you won't want to miss. Use this link to get 3 months of Kajabi for only $99.

As you might have guessed, the above link is an affiliate link, and I earn a commission as a Kajabi Partner if you sign up.

As always, I only recommend products I trust, love and use myself.

PS:

The regular price is $199/month (USD) for the Growth Plan, which I currently pay, so this is a steal!

THE ACCOUNTABILITY

Want to start a business but don't know what to sell?

Ask yourself these questions.

💡What's something you're good at?

💡What's a topic you can talk about for days?

💡What do friends and family typically ask you for help with?

💡What are your hobbies?

💡What's something you can do effortlessly?

☑︎Write down the answers to each of these.

☑︎Research ways you can monetize them.

THE COURAGE

THE KNOWLEDGE

There are three main types of income.

ACTIVE INCOME

This income requires an active exchange of skills or services for compensation.

If work stops, the income stream shuts off.

Examples: Earned income, profit or business income (depending on the nature of the business)

SEMI-PASSIVE INCOME

This income requires work upfront and little ongoing work to generate revenue.

Examples: rental income, profit or business income (blogs, affiliate marketing, digital products), royalties.

PASSIVE INCOME

This is income generated without any ongoing work required.

It may require some work upfront to get things running smoothly, but you don't have to work to generate any income actively.

Examples: Dividend income, capital gains, interest income.

That's it for this week's STACK!

Talk to you next week,

But until then...Keep Stacking!

about the newsletterEvery Saturday, subscribers will receive one money tip, one tool, one actionable step, one word of courage and learn a new finance term to help you gain control of your finances in less than five minutes.

Free resourcesKeep reading the latest NEWSLETTERS

How to cycle sync your finances